Mobile Platform

| Android | : |

Application Download Link |

| IOS | : | Application Download Link |

Call Center

| Hotline | : |

+951 8386255 ~ 258 / +959 787877702 ~ 05 |

| Viber | : |

+959 787877702, +959 787877705 |

Head Office

No. 416, Corner of Mahabandoola Road and Mahabandoola

Garden St, Kyauktada Township, Yangon, Myanmar

- Market trading hours are from 9:30 am to 1:00 pm.

- Matching Time : 10:00 AM, 10:30 AM, 11:00 AM, 11:30 AM, 12:00 PM, 12:30 PM, 1:00 PM.

- Orders placed after 1:00 PM will be processed as Off-Market Orders and will be queued for the first matching time when the market opens the next day

Market Order

- Market order is an order to buy or sell securities without specifying a price, prioritizing immediate execution over price conditions.

- Market order takes priority over limit orders and is more likely to be executed.

- Market order also carry the risk that the final execution price may be significantly higher or lower than the investor's expectation.

Limit Order

- Limit order is an order placed by specifying the price at which the investor seeks to buy or sell shares.

- Limit Orders have lower priority than Market Orders at matching.

- Limit orders help avoid the risk of buying or selling at an unexpected price, they may not be executed if the market price does not meet the investor's specified limit.

- Price priority: The order price that is superior than other orders gets filled first and a market order has the first price priority.

- Time priority: If the price priority is same, earlier order has priority to get filled first.

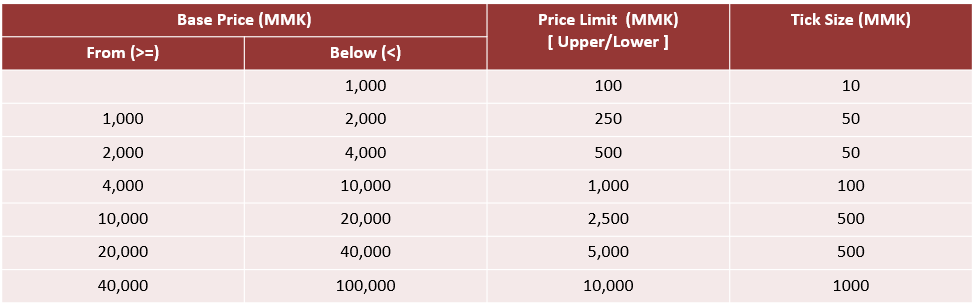

- Upper Limit means the maximum a share price can move up during a day.

- Lower Limit means the maximum a share price can move down during a day.

- Tick Size mean minimum amount you can move up or down when placing orders.