What is IPO?

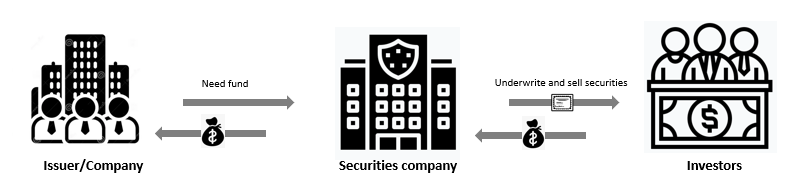

- Initial Public Offering (IPO) refers to the process through which a privately owned company offers its securities, typically common shares, to the public for the first time.

- The primary reasons for going public (IPO) is to raise capital from investors. The funds obtained from selling shares can be used for various purposes, such as expanding operations, investing in new projects, acquiring other businesses, or paying down debt.

- Going public through an IPO also elevates a company's profile and credibility, which can help attract new customers, partners, and top talent, while providing a significant marketing advantage.

- IPO underwriting involves the underwriting of all or part of a company shares, helping facilitate the sale and distribution of these securities to the public.

IPO Related Services

Depending on the specific circumstances of each company, some or all of the following services are typically involved in a IPO underwriting :

- Corporate Restructuring

- Financial Restructuring

- Corporate Governance Restructuring

- Due Diligence

- Valuation and Pricing

- Drafting Prospectus

- Regulatory and Legal Compliance

- Regulatory Filings

- Book Building and Book Running

- Roadshows

- Underwriting, Sale, Allocation and Distribution of shares

For more information about our services, please contact us here.